Testamentary Trusts

Testamentary Trusts are one of the most powerful Estate Planning tools available.

A Testamentary Trust is a trust set up in a Will that is created to protect assets for the benefit

of others. It is established by a person’s Will and remains dormant,

ready to start when a person dies.

Here are some of the benefits of having a Testamentary Trust Will:

Protect

your assets

from divorce and bankruptcy risks

Create peace

of mind

that your assets will be passed on and distributed as per your wishes

Provide a sense

of security

that your family and loved ones will be looked after

when you die

Save your

family tax

after you die

How do they work?

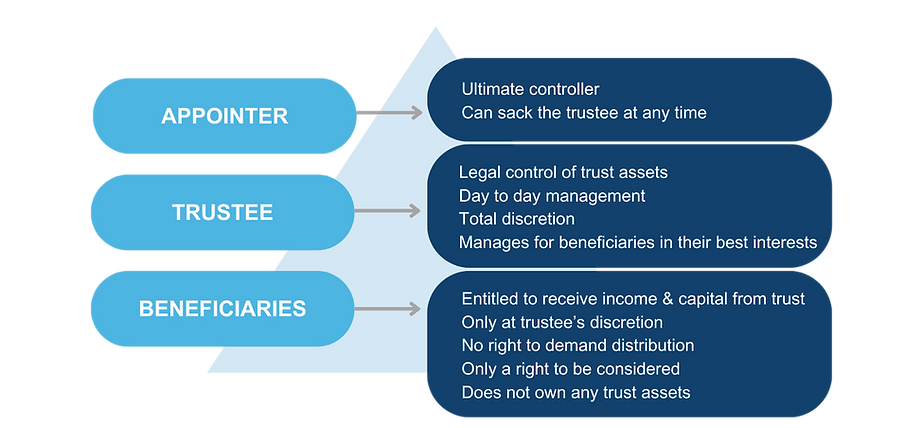

Trusts work by separating control of the assets held in the trust from the benefit. The person who has control of the trust assets is the Trustee. The Trustee is the legal holder of the assets and is responsible for the day to day management of the trust and the due administration of the trust.

An effective testamentary trust should have many people who can potentially benefit from the assets in the trust (the technical term for these people are Beneficiaries) and each beneficiary’s entitlement should be at the complete discretion of the Trustee.

This discretionary nature of the trust is what makes the trust so powerful for asset protection. Because none of the beneficiaries own the trust assets and their only right is to be considered by the trustee, it is very difficult for someone to argue that the assets of the trust belong to any one of the beneficiaries.

A trustee can also be one of the beneficiaries of the trust, and if that is the case, then the trust assets will ‘look and feel’ more like that person’s assets because they are in control and can choose themselves or their family members to benefit from the trust. If you are simply a beneficiary without being a trustee, then your entitlements in the trust are at the trustee’s discretion.

It is important to you to protect inheritance from relationship risks, eg:

- divorce

-

separation

-

your surviving spouse re-partnering after you die

You are leaving assets to a beneficiary who cannot be trusted to manage their inheritance appropriately and you are worried they will waste it

It is important to you that the inheritance is protected from bankruptcy risks

You are leaving at least $500,000 (including super and life insurance) to one or more people

You want to leave an inheritance to minors who can each receive approx. $18,000 tax free income each year from investing the inheritance

An intended beneficiary is currently residing overseas

You should consider a

Testamentary Trust Will if:

If you have children under 18 years

A TT is a very powerful tool for families with young children. In particular, the TT offers the following advantages:

-

Your surviving spouse might re-partner after you pass away, but the inheritance you leave your family will be protected for your children in the trust away from the influence of any new partner and protected from any future family law risks.

-

If you and your spouse both pass away together, your children won’t automatically get their hands on their inheritance when they turn 21 (which is the case if you don’t use a TT). You can choose who is responsible for making financial decisions about the inheritance until the children reach financial maturity. How many people have you heard of who came into their inheritance far too early and wasted the lot?

-

The tax treatment could make a huge difference to your family’s financial wellbeing.

For example: If you die leaving a spouse and 3 minor children, then roughly the first $66,000 of income earned from investing the inheritance through the trust could be tax free and used to pay for the children’s living and education expenses.

If you didn’t have a trust, then your surviving spouse would need to pay tax on that income at their marginal tax rate (in addition to any other income, for instance, their salary) and then pay for those living and education expenses with after tax income. These tax savings continue generation upon generation so that your children can ultimately then apply tax free amounts to their children.

If you have children over 18 years

If you have adult children, you should consider leaving an inheritance to them through a TT, rather than as a direct gift. If you choose, your child can still control ‘their’ TT (so it looks and feels like their money), but using the TT will give them the following advantages:

-

The inheritance you leave your child is significantly less likely to be exposed to any family law risks if your child separates or divorces.

-

If your child is in a high risk occupation (e.g. carrying on a business, a director, or at risk of negligence - such as engineers, lawyers, doctors, accountants, health professionals etc.), then the inheritance you leave your child could be exposed to those risks if you do not use a TT. A TT protects the inheritance from any bankruptcy claims.

-

The tax treatment could amplify the impact of the inheritance, because they can access tax free income to pay for their childrens’ (i.e. your grandchildrens’) living and education expenses.

For example: If you leave an inheritance to your child who has 3 minor children of their own, then roughly the first $66,000 of income earned from investing the inheritance through the trust could be tax free and used to pay for your grandchildrens’ living and education expenses.

If you didn’t have a trust, then your child would need to pay tax on that income at their marginal tax rate (in addition to any other income they may earn from other sources) and then pay for those living and education expenses with after tax income. These tax savings continue generation upon generation so that your grandchildren can ultimately then apply tax free amounts to their children and so on.